A new process has been introduced by the Australian Taxation Office (ATO) for nominating a registered agent.

This new process is called ‘Client-to-agent linking’ and, effective from 13 November 2023, it applies to all taxpayers with an Australian Business Number (ABN), excluding sole traders.

As a result of this change, you will need to take certain steps to authorise Peter Chung Lam King to act as tax agent on your behalf, as explained further below.

Why has Client-to-agent linking been introduced, and when does it need to be completed?

Registered agents have digital access to their clients’ tax information and the functionality to lodge returns and forms through the ATO’s online services. Client-to-agent linking was introduced to strengthen the security of these online services.

Client-to-agent linking also helps protect a client’s information (e.g., from identity theft) by requiring them to securely nominate a registered agent using the ATO’s online platform, Online services for business.

From 13November 2023, this new nomination process must be completed by a client with an ABN (except a sole trader)if they are:

• engaging a new registered tax or BAS agent, or payroll service provider to represent them; or

• changing the authorisations given to an existing agent (for example, to start representing the client for a new obligation such as income tax, FBT, or to represent a new entity in the client group).

Once this process has been completed, the agent can connect to the client and access their information.

Importantly, clients do not need to do anything if they are already represented by a registered agent, and they are not making any changes.

What do you need to do?

You must complete the new process to nominate Peter Chung Lam King as your authorised agent. This requires you to do the following:

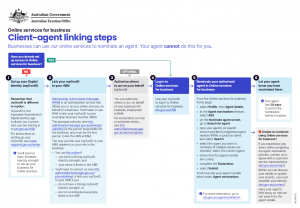

1. Nominate Peter Chung Lam King as your registered agent in Online services for business – To do this, you will need to follow the client-to-agent linking steps outlined in the enclosed document from the ATO, which vary depending on whether or not you have already set up access for Online services for business. In summary, this means:

A. If you have already set up access to Online services for business and have an appropriately authorised myGovID:

Action Required Instructions

1. Log into Online services for business Use your authorised myGovID to log in.

2. Nominate your authorised agent From the home page:

• select Profile, then Agent details;

• at Agent nominations, select Add;

• on the Nominate agent screen, go to Search for agent and search for us using either our RAN 66315000 or Peter Chung Lam King;

• complete the Declaration and select Submit;

• confirm that you can see our details listed under Agent nominations; and

• notify our office that these steps have been completed as soon as practicable

B. If you have NOT set up access to Online services for business and do NOT have an appropriately authorised myGovID, before you follow the steps in the above table:

Action Required Instructions

1. Set up your myGovID This is the Government’s Digital Identity app and can be set up at www.mygovid.gov.au/setup

It is advisable you establish a ‘Strong’ Identity strength to assist with subsequent steps.

2. Link your myGovID to the ABN You will need to use the Government’s Relationship Authorisation Manager (‘RAM’) to link your myGovID to your ABN. This should generally be done online.

If this link does not work, copy and paste the following web address into your internet browser: info.authorisationmanager.gov.au/principal-authority#How_to_link

3. Authorise others (optional) This is an optional step if you wish others to act on behalf of your business.

4. Log into Online services for business and nominate your authorised agent Follow the instructions in the table above.

The steps outlined in Table A or B (whichever applies) must be repeated by each individual or by an authorised person of each entity in your group wishing to nominate Peter Chung Lam King to act as their authorised agent.